The audit risk assessment is not a guarantee you will not be audited.Does not provide for reimbursement of any taxes, penalties or interest imposed by taxing authorities. H&R Block Audit Representation constitutes tax advice only. TurboTax® offers limited Audit Support services at no additional charge. Prices based on, and (as of 11/28/17).Windows® is a registered trademark of Microsoft Corporation. TaxAct® is a registered trademark of TaxAct, Inc. TurboTax® and Quicken® are registered trademarks of Intuit, Inc. H&R Block is a registered trademark of HRB Innovations, Inc.Terms and conditions apply see Accurate Calculations Guarantee for details.

#Irs refund status software

#Irs refund status free

Additional terms and restrictions apply See Free In-person Audit Support for complete details. It does not provide for reimbursement of any taxes, penalties, or interest imposed by taxing authorities and does not include legal representation. Free In-person Audit Support is available only for clients who purchase and use H&R Block desktop software solutions to prepare and successfully file their 2021 individual income tax return (federal or state).The information available on Where's My Refund? is the same information available to IRS phone assistors. The IRS updates the tool once a day, usually overnight, so there's no need to check more often.Ĭalling the IRS won't speed up a tax refund.

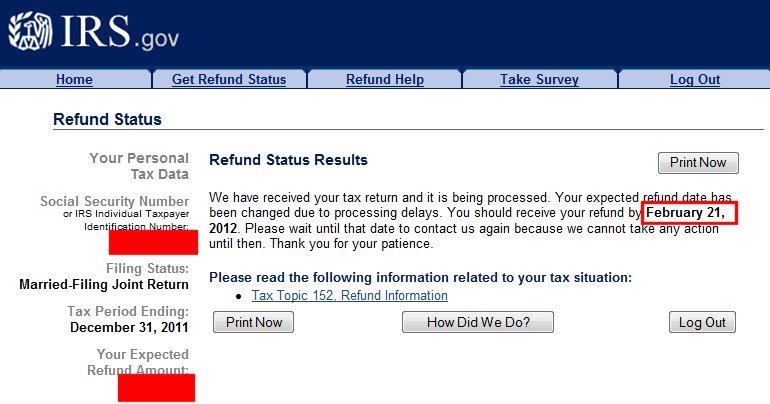

To use Where's My Refund?, taxpayers must enter their Social Security number or Individual Taxpayer Identification Number, their filing status and the exact whole dollar amount of their refund. The tool's tracker displays progress in three phases: Taxpayers can start checking on the status of their return within 24 hours after the IRS acknowledges receipt of an electronically filed return or four weeks after the taxpayer mails a paper return. The IRS found no issues with their return.They choose to get their refund by direct deposit.

Taxpayers who claimed the earned income tax credit or the additional child tax credit, can expect to get their refund March 1 if: The IRS will contact taxpayers by mail if more information is needed to process their tax return. Many banks do not process payments on weekends or holidays.The return could be affected by identity theft or fraud.The return may include errors or be incomplete.Here are a few reasons a tax refund may take longer:

While most tax refunds are issued within 21 days, some may take longer if the return requires additional review. Where's My Refund provides a personalized date after the return is processed and a refund is approved. Taxpayers can start checking their refund status within 24 hours after an e-filed return is received. It's available anytime on IRS.gov or through the IRS2Go App. Tracking the status of a tax refund is easy with the Where's My Refund? tool.

0 kommentar(er)

0 kommentar(er)